ASKOL Charged Assets Pools and Vaults

Composable liquidity pools and multi-asset vaults

Balancer style (V2) assets vaults and composable liquidity pools implementation for ASKOL Charged Markets

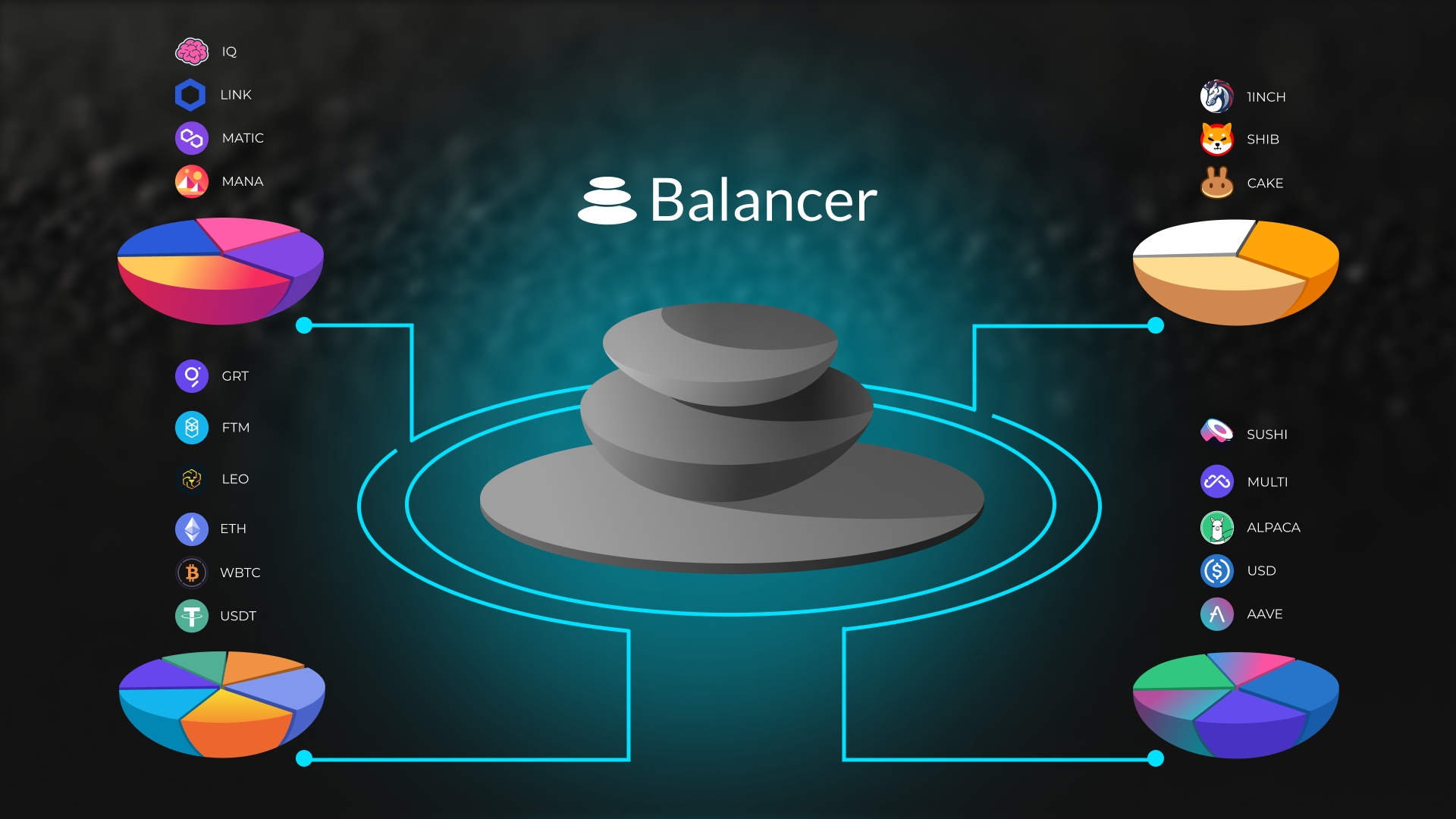

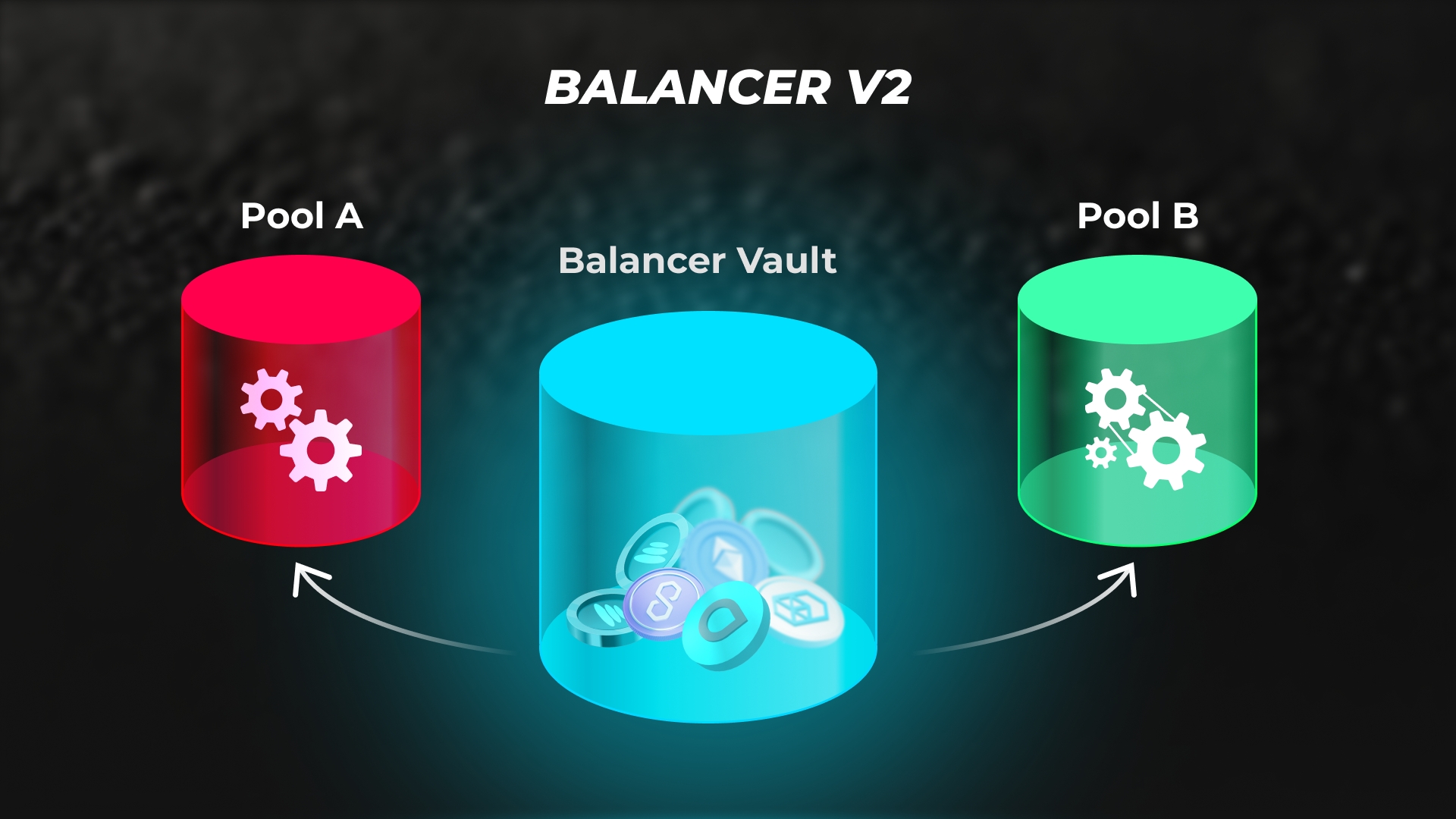

Balancer style vaults and pools are proven, effective and permissionless on chain DeFi services which will be used in part to enable ASKOL charged assets markets services. Balancer smart contract architecture will enable users to cost effectively provide liquidity in a variety of approved crypto assets to charged assets market pools with the goal of supporting high level of TVL (Total Value Locked) across ASKOL's charged assets markets. Balancer pools in principal attempt to strike an optimal balance between transaction costs and perpetual yield to maximize rewards for all participants. This makes them attractive to investors who want to profit from DeFi while also taking advantage of lower trading fees for cross trades across the ASKOL charged markets ecosystem. The implementation of balancer's vaults and composable liquidity pools smart contracts architecture for ASKOL charged assets markets offers an automated and trustworthy technology to efficiently allocate, manage and store liquidity on the blockchain. Balancer pools also limit counterparty risks since there are no central authorities involved in the process.

Benefits of Balancer's tech for ASKOL Charged Assets Markets:

Balancer pools and vaults play an important role in the ASKOL markets services ecosystem by allowing to pool assets amongst a variety of charged assets markets, users can increase their portfolio choices and better manage risks without having to trade each asset separately. Balancer pools also allow real-time rebalancing of market assets pools and provide programmable liquidity via smart contracts. Balancer's permissionless pools provide users flexibility, allowing to access specific risk categories and data points to improve portfolio strategies and better manage a broad range of assets.

Last updated