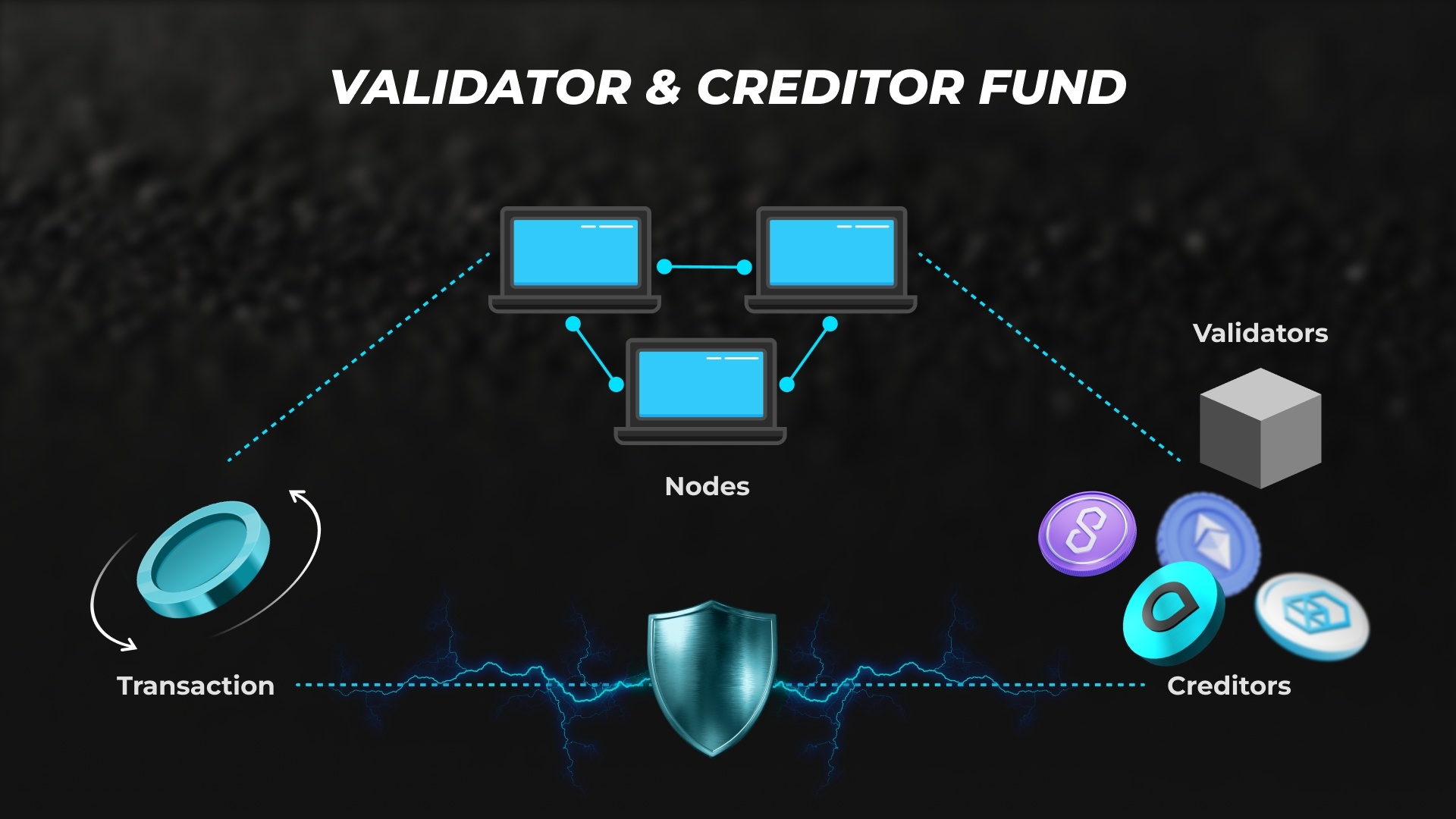

ASKOL Validator and Creditor Fund

Power Seekers can can validate and lend by holding ASKOL LPs

ASKOL intends to establish a validator and creditor fund after the release of (V1). The fund will consist of pools in which Power Seekers can participate by locking ASKOL LPs. The validator fund will focus on MEV (maximum extraction of value) and will offer traders the ability to increase leverage in derivative markets without having to commit additional capital. Important to note, the creditor fund does not charge an interest rate but instead receives a fixed fee every 30 days for supporting leveraged transactions in the ecosystem. ASKOL intends to maintain a 1 : 5 leverage ratio to ensure a healthy open decentralized financial markets services ecosystem.

Further details will be published as the development of ASKOL-charged markets progresses.

Last updated