ASKOL and ASKOL LP

ASKOL and ASKOL LP are algorithmic in-app units that power the ASKOL charged assets and dNFT derivatives markets services

ASKOL is an in-app stable unit pegged to the US dollar powers the transactions and settlements on all ASKOL hybrid assets and dNFTFi derivatives markets. ASKOL enables users to operate on any blockchain where ASKOL markets are supported.

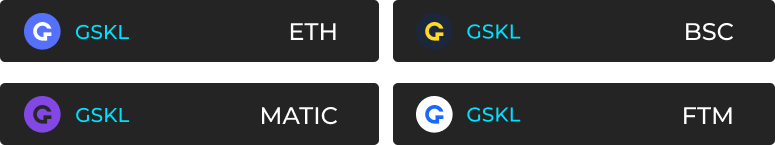

ASKOL stable in-app units can be purchased only on ASKOL platform via ASKO Gateways tokens on the blockchain where ASKOL markets are deployed. For example, on Ethereum ASKOL can be purchased with ASKO Gateways tokens, which are publicly traded ERC20 fungible tokens, that can be easily acquired on participating public exchanges. While on Binance Smart Chain ASKOL can be purchased with rASKO Gateway tokens, which are publicly traded BEP20 fungible tokens, and can be easily acquired on participating public exchanges, etc... ASKOL exists in-app and can be acquired only via ASKO Gateways tokens which can be purchased on participating public crypto exchanges (DEXs, CEXs). ASKO GATEWAYS TOKENS

As perviously mentioned there are two types of ASKOL algorithmic in-app tokens:

Token Type I: ASKOL performs several key functions to charge its markets, acting as as a transactional power unit, plus allowing users to perform settlements for all market premiums, rebalance collateral & market positions, and acts as a rewards unit which helps market creators, borrowers, traders and liquidity providers to secure on-going rewards for their participation, further enhancing user risk and reward profiles over time.

ASKOL provides users with monetizable vesting rewards, which can be claimed or used as charge to offset fees through the PowerSeeker's "Charging Station"

Token Type II: ASKOL LPs represents the mean average LP token value of ASKO Gateways tokens and therefore will fluctuate accordingly as per its public markets pricing. Therefore ASKOL intends to introduce a ASKOL LP risk reserve validator fund that will be used in part to off-set inherent market risks by running clusters and sub-sets of validator nodes on the relevant blockchain networks, with earnings to be used for on-going token buy backs and burns to ensure consistent off-set for market volatility.

ASKOL LPs entitle "PowerSeekers" to borrow dNFTb derivatives representing any underlying hybrid asset class in any ASKOL charged assets market. ASKOL LP units can only be received and used in-app by locking Gateway token LPs .

ASKOL LPs allow PowerSeekers to borrow dNFTb derivatives at a 0% APR, on a 1 : 1 collateral to asset ratio basis.

In cases when ASKO Gateway LP value drops by 20% or more the PowerSeeker will be asked to add charge to their borrowing positions. This can be done either providing additional ASKOL LPs for the difference or by taking a credit line, to make up the difference. ASKOL credit rates will be published on the platform and updated every 30 days.

Last updated